how do i get a tax exempt id from home depot

Tax-exempt organizations must use their EIN if required to file employment tax returns or give tax statements to employees or annuitants. So Lets Try itHow to get Home Depot Tax Exemp.

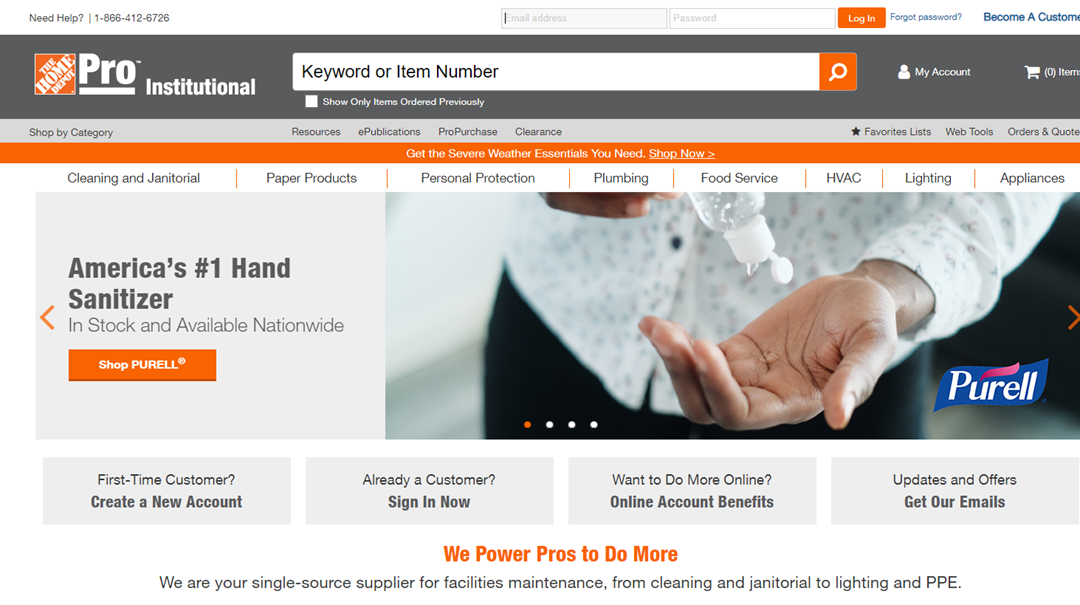

How To Register For A Tax Exempt Id The Home Depot Pro

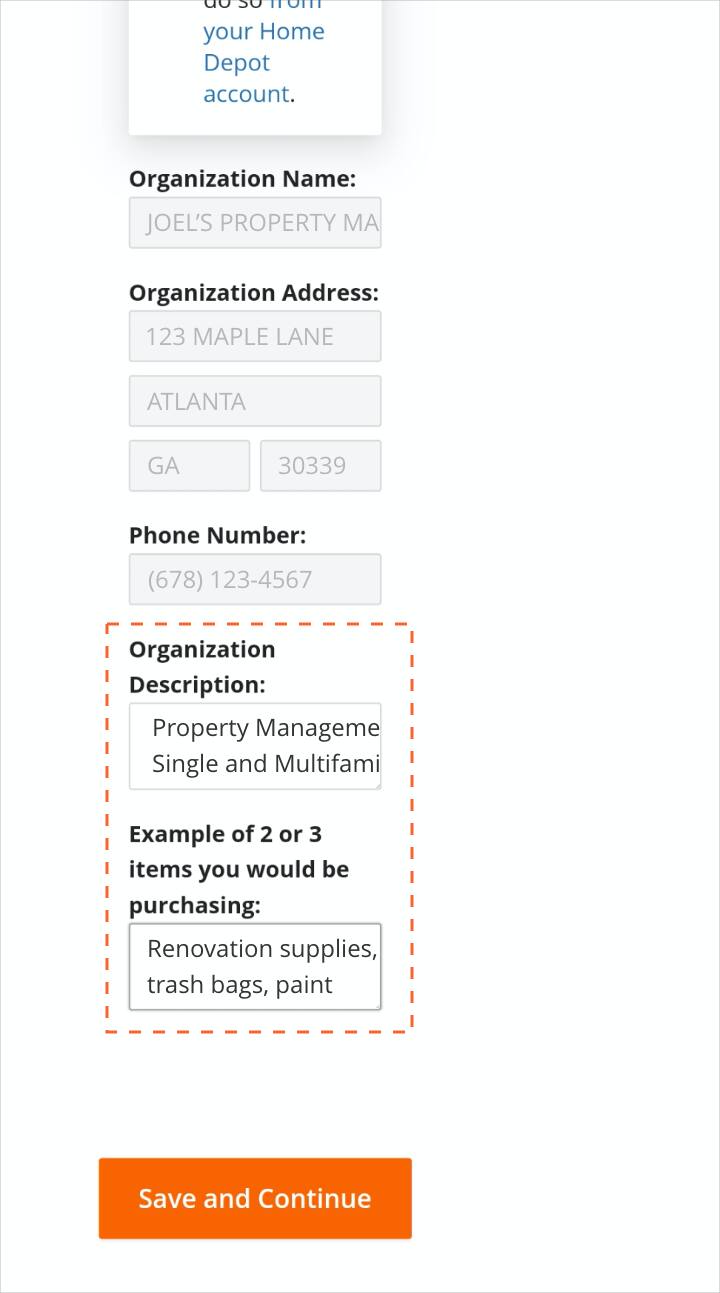

To apply for a Tax ID you need to go to The Home Depots website here and provide the following information.

. As of January 3 2022 Form 1024 applications for recognition of exemption must be submitted electronically online at wwwpaygov as well. A grace period will extend until April 30 2022. Visit the Appropriate Website.

Find the document you want in our library of legal templates. Keep to these simple instructions to get Home Depot Tax Exempt ready for sending. If you already have a The Home Depot tax exempt ID skip to Step 10.

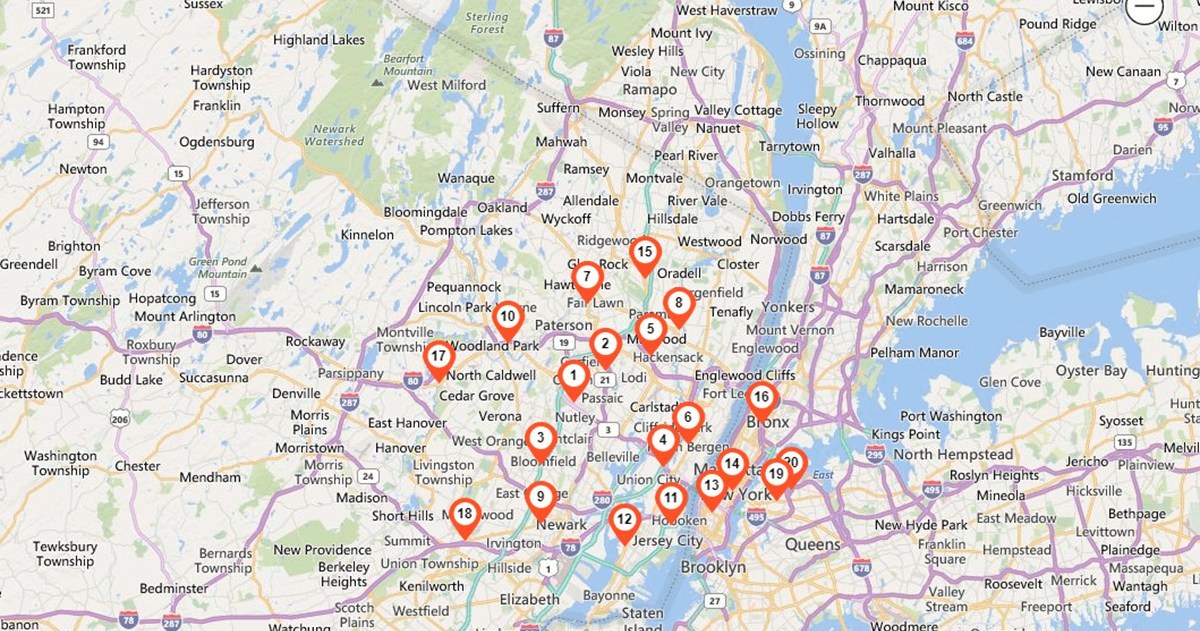

If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. Click here for Tax Exempt Application and Tax Exempt Rules For the quickest turnaround email your completed application and related attachments to our tax department. A hold-your-hand video that will help you gain tax exemption from Home Depot.

Here you will find information that will allow you to reach the goals you have in life. Phone number Make sure this phone number is registered. Step 1 To shop tax free you need a Tax Exempt ID from The Home Depot.

You will have no card or other means of identifying the account. Here it is guys. This number is different from your state tax exemption ID.

Easily follow these steps and start dropshipping using Home De. Visit the website for the Department of Revenue or Comptroller for the state of the non-profit. Steps for obtaining tax-exempt status for your nonprofit.

File Form 1023 with the IRS. Provide a detailed business purpose. Pay the necessary filing fees.

Apply for an EIN. Posted by 3 years ago. Click the Search for a.

Open the form in the online editor. Establish your tax exempt status. Welcome to my channel.

You must go to a Home Depot and test your account by giving them your Home Depot Tax Exempt ID number. Let us know and well give you a tax exempt ID to use in our stores and online. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number.

How do I find my tax-exempt number. Up to 8 cash back Are you a tax exempt shopper. Your Home Depot Tax ID Number is 540946734 540946734 Please present this card to the cashier each time you make a tax exempt purchase.

Sign in with the business account you will be making. How do I apply for sales tax exemption in NY.

Iama President Of A 501c3 Tax Exempt Non Profit That Is Called Fale We Teach People To Pick Locks Ama R Iama

How To Register For A Tax Exempt Id The Home Depot Pro

Home Depot Donation Request Form Fill Out And Sign Printable Pdf Template Signnow

How To Apply For Your Resale Tax Status From Home Depot Youtube

Can You Avoid Paying Sales Tax At The Home Depot Hammerzen

26 Best Ways To Save At Home Depot Every Time You Shop

How To Register For A Tax Exempt Id The Home Depot Pro

Tax Exempt Purchases For Professionals At The Home Depot

Cricut Explore Air 2 Just 143 65 Reg 227 Free Shipping At Home Depot Living Rich With Coupons

How To Register For A Tax Exempt Id The Home Depot Pro

Fillable Online Further 70 Appellants Fax Email Print Pdffiller

How To Get Home Depot Tax Exempt Id In 20 Minutes How To Get Home Depot Tax Exemption Youtube

How To Purchase From Home Depot Uf Procurement Uf Procurement

Amazon Fba Sales Tax Collection 2021 Usa Everything You Need To Know Just One Dime Blog

How To Register For A Tax Exempt Id The Home Depot Pro

Help You Get Homedepot Tax Exempt All States The Legal Way By Ayoubhassab Fiverr

Page 10 24 Best Tax Exempt Services To Buy Online Fiverr

36 Home Depot Hacks You Ll Regret Not Knowing The Krazy Coupon Lady